The International Conference on Financial Literacy and Economic Wellbeing (ICFLEW 2025), organized by BRAC Business School, BRAC University, Dhaka, on June 26, 2025, served as a vital platform for academics, industry professionals, and policymakers to discuss the critical intersection of financial literacy, competency, inclusion, and digitalization, aiming to empower individuals and organizations.

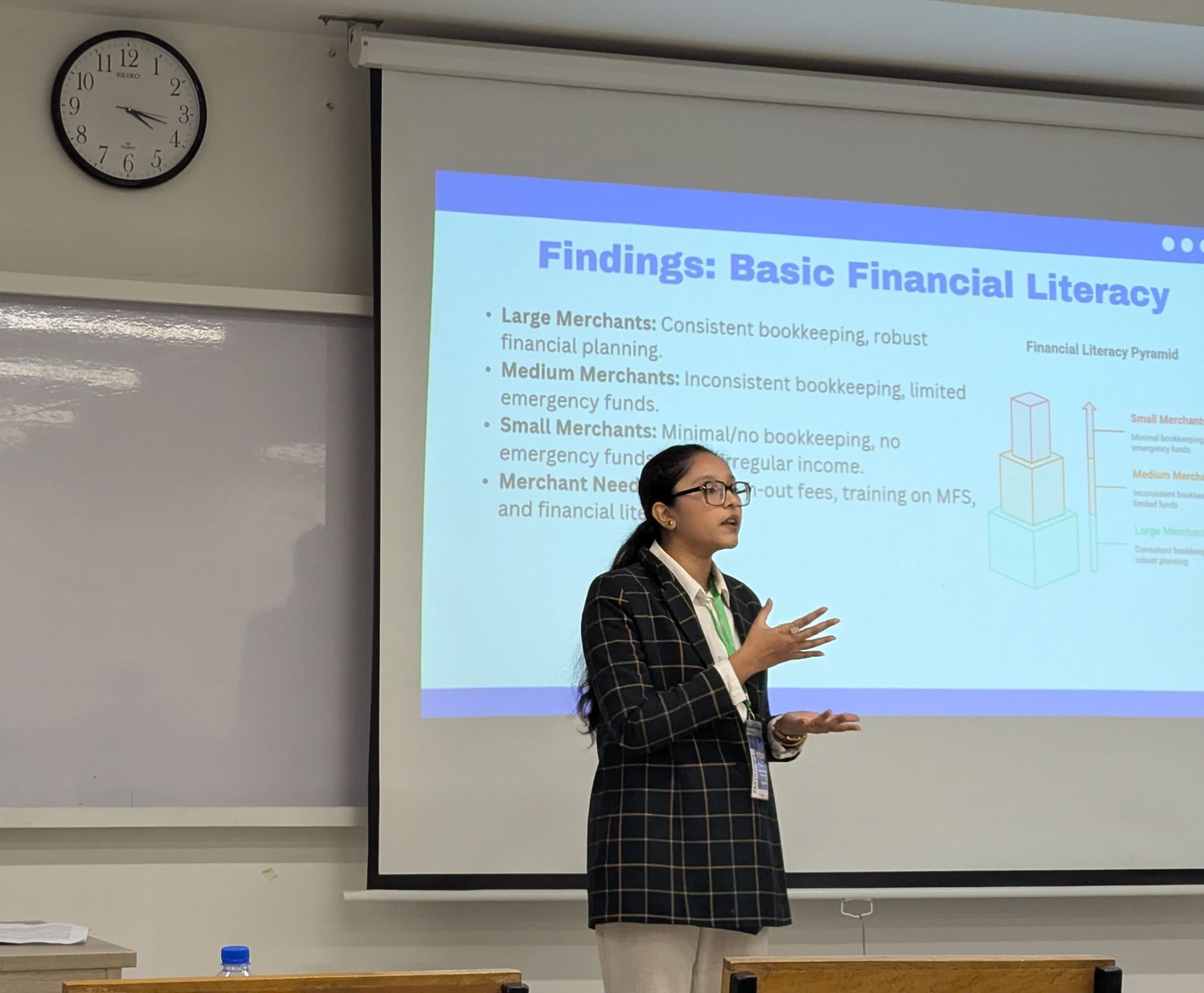

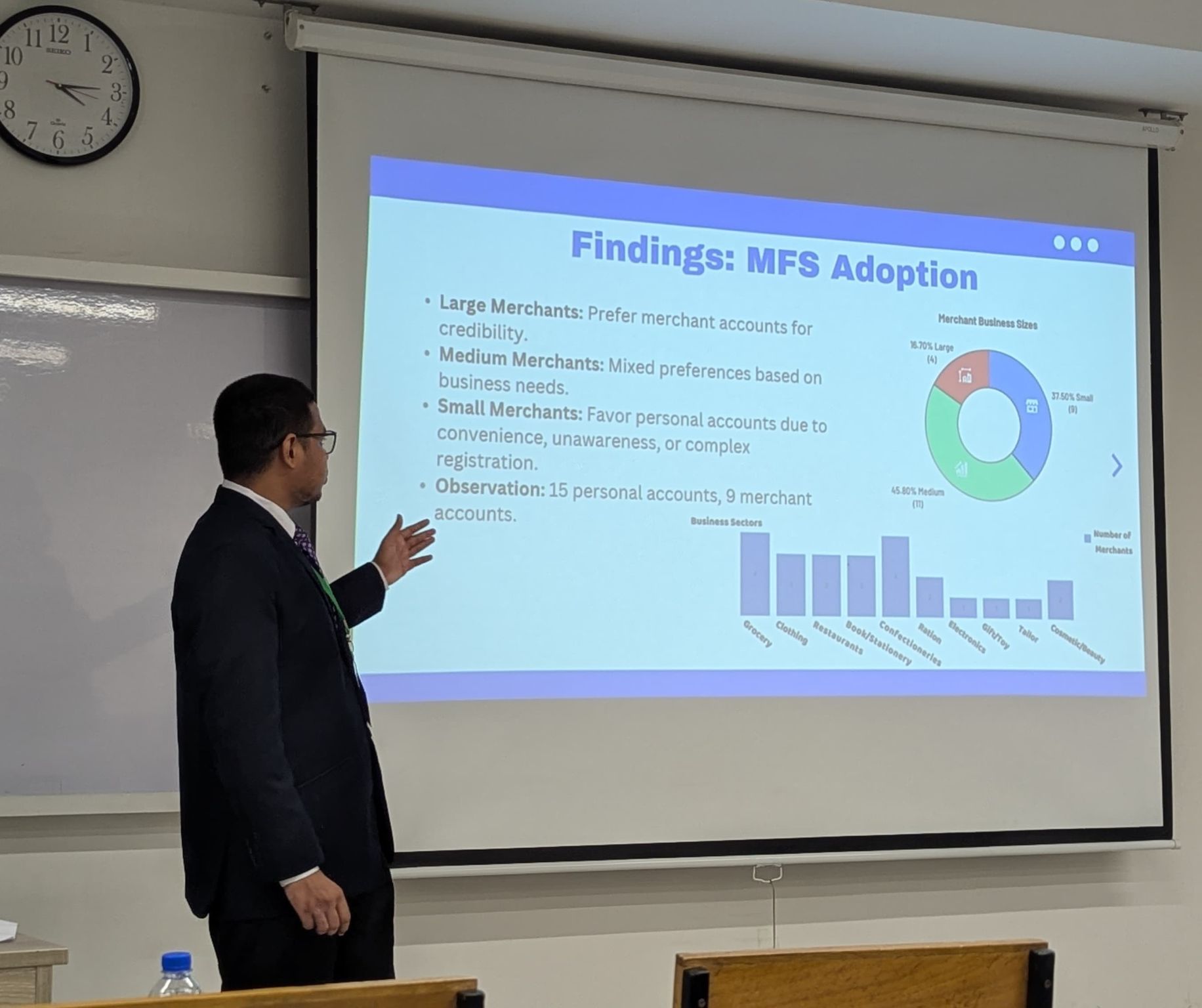

Our research paper, titled "Exploring Mobile Financial Services (MFS) Adoption and Basic Financial Literacy among Market Merchants in Sylhet," was successfully presented and published in the conference proceedings.

Co-authored by Md Golam Mubasshir Rafi (Second-Year Student) and Israt Zarin Ruponty (First-Year Student) from Army Institute of Business Administration - Sylhet, this study investigated the barriers to MFS merchant account adoption and gaps in basic financial literacy among market merchants in Sylhet. Our findings revealed crucial insights, highlighting the need for simplified registration, reduced cash-out fees, and targeted workshops to enhance financial inclusion and management among merchants.

The presentation was a highlight. We meticulously crafted our slides and were deeply honored by the positive feedback and appreciation received from the panel members, esteemed professors, and the audience regarding their clarity and visual appeal.

Our findings offer practical insights for policymakers and MFS providers, while theoretically enriching literature by applying a behavioral economic lens to Sylhet's market, linking trust and formality to MFS adoption. This scalable framework supports Bangladesh's cashless economy.

Participating as undergraduates (2nd Year & 1st Year) provided invaluable insights into academic research, peer feedback, and scholarly communication, strengthening our commitment to impactful work. Through this project, we gained invaluable experience in comprehensive research methodologies, academic writing, and public presentation at an international forum. This journey has not only strengthened our analytical and communication skills but also deepened our understanding of real-world financial challenges and potential solutions.

We extend our sincere thanks to the ICFLEW 2025 Program Committee, BRAC Business School, our teachers, peers, well-wishers, and the Army Institute of Business Administration, Sylhet, for their immense support.

Our 3-month journey showed us the power of dedication and teamwork. This collaboration made us winners, proving that the greatest rewards come from gaining knowledge and making an impact.

— Mubasshir Rafi and Israt Ruponty